Angel Tax GS: 3 EMPOWER IAS

Angel Tax

Mains Question:

Q) The angel tax had been in the spotlight in the past with the startup ecosystem calling it an unfair tax burdening the community. Comment

|

Table of Content

- In news

- Important facts

- Angel tax

- Angel tax investors

- Benefits

- Problems or concern areas

- Impact on startups

- Government initiatives

- Way ahead

- Global practices

|

In news:

- No Angel Tax for DPIIT registered startups

Important points from the news:

- Recently, Finance Minister has provided relief for the start-up community by announcing that angel tax will not be applicable on entities registered with the Department for Promotion of Industry and Internal Trade (DPIIT).

- Sec 56(2) (viib) of the Income Tax Act — under which the tax is levied — would stay, it would not be applicable on start-ups that register with the DPIIT.

- This section is important for income tax so it will continue. However, it will not be applicable to registered startups

- Angel tax was looked upon as a major hindrance for early stage start-ups that were looking to attract funding from angel investors and other entities.

- The government will set up a separate dedicated cell housed under the Central Board for Direct Taxes (CBDT) for addressing problems of startups. Startups with an income tax issue can approach this panel.

What is angel tax?

- An angel investor is one who provides capital for a business start-up, usually in exchange for convertible debt or ownership equity.

- It is the tax levied on such investments made by external investors in startups or companies.

- At times, capital is raised by unlisted companies via issue of shares where the share price is seen in excess of the 'fair market value' of the shares sold.

- So the entire investment is not taxed but only the amount that is considered above “fair value” valuations of the startup.

- Currently, funds from angels are subjected to over 30% tax if it is more than the fair market value (FMV).

- It was introduced in the 2012 Union Budget to arrest laundering of illegal wealth by means of investments in the shares of unlisted private companies at extraordinary valuations.

- However, under certain conditions, exemption to startups is offered under Section 56 of the Income Tax Act.

- While aimed at curbing money-laundering, the angel tax also resulted in a large number of genuine start-ups receiving notices from the tax department.

Who are Angel investors?

- Angel investors are a class of well-to-do investors, usually experienced industry folk who take equity stakes in startups.

- They take very early-stage businesses under their wing. Typically, institutional investors such as venture capital funds or private equity funds do not like to commit capital to tiny businesses.

- Funds contributed by Angel Investors are known as Angel Funds. Angel Funds in India, are regulated by SEBI.

How will it benefit?

- Stringent rules on angel tax have had an adverse effect on investor confidence in startups.

- The relaxations will help the start-ups which are in desperate need for capital to fund their growth and other business requirements.

- So many young companies that have received notices from the IT Department in the last few years will be relieved by the change in rules.

- The decision to fast-track GST refunds within 30 days and CBDT’s move towards setting up a dedicated cell to address tax problems will further ease business environment.

- It will be beneficial for MSMEs because the government has considered waiving ‘angel tax’ and simplifying the flow of risk capital for young companies, which will allow early-stage ventures to raise seed capital.

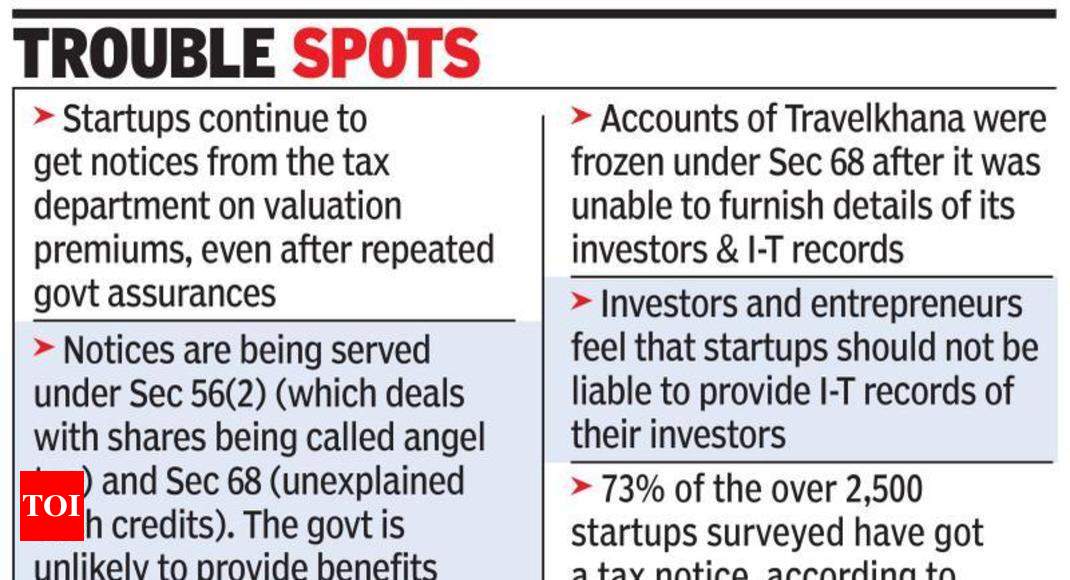

Why is Angel tax problematic?

- The angel tax is a 30.9 % tax levied on investments made by external investors in startups or companies. The entire investment is not taxed, only the amount that is considered above “fair value” valuations of the startup, classified as ‘income from other sources’ in the Income Tax Act of India.

- The problem arises because startups are often valued subjectively on the basis of discounted cash flows, without taking into account intangibles like goodwill.

- This can cause differing interpretations of “fair value” and leave startups vulnerable to unduly high taxes because the taxman feels the investment is too high over their valuation.

- Income-tax officers claim that the scrutiny on start-ups is mainly due to concerns over money laundering

- There is no definitive or objective way to measure the ‘fair market value’ of a startup. Investors pay a premium for the idea and the business potential at the angel funding stage.

Impact of Angel Tax on Startups:

- Since many unlisted and early-stage startups rely heavily on funding the taxation will limits investors from putting their money and trust on fledgling and early-stage startups, which in effect stifles more people to come forward and start their own.

Government initiative to protect startups:

- Start-up India Initiative: Tax exemptions on income tax for three years and Tax exemption on capital gains and on investments above fair market value (angel tax)

- Tax exemptions: Tax exemption to startups under Section 56 of the Income Tax Act in cases where the total investment including funding from angel investors did not exceed Rs 10 crore. This limit has been increased to 25 Crores recently.

- Changed Definition: The government has amended the definition of a startup, entity shall now be considered a startup up to seven years, at present, the period of consideration is five years, thereby making it easy to avail of incentives and promote entrepreneurship under the Startup India scheme.

Way ahead:

- Income Tax department should lay down detailed parameters for fair assessments, before making such additions to income, and to check the genuineness of the transaction.

- The government needs to make similar tax provisions for friends and families that are not categorized as angels and have backed startups that are not DPIIT registered.

Global practices:

- China: Baidu, Tencent, and Alibaba are a few well-known names that have emerged from the Chinese market. Preferential tax policies allow 70 per cent of total investment to be deducted from taxation two years after investment in high-tech start-ups

- Singapore: Tax incentives are available to start-ups and investors, even offering qualifying start-ups up to Singapore $200,000 tax exemption on their first three consecutive years of assessment (YAs).

Source)

https://www.thehindu.com/business/escape-from-angel-tax-delights-start-ups/article29236616.ece